Estate Planning Lawyer Memphis, TN

The purpose of an estate plan is to create a roadmap for your assets and legacy. Our Memphis, TN estate planning lawyer understands how sensitive a matter it is to plan for what happens after you pass on. For many people, this task is—understandably—often delayed until later on in life. But it’s a common misconception that estate planning is reserved only for the wealthy. Planning is a relevant topic for anyone with cash, debts, or assets. Whether your estate is big or small, our estate lawyer can help you build a customized plan that reflects your wishes and safeguards your legacy. We have the compassion and experience needed to guide you throughout this process. Contact our team at Patterson Bray PLLC today to learn more about your options and our comprehensive planning services.

Table of Contents

- How We Can Help You

- The Basics Of A Will

- Common Components Of An Estate Plan

- Memphis Estate Planning Infographic

- Estate Planning Statistics

- FAQs

- Patterson Bray PLLC, Memphis Estate Planning Lawyer

- Contact Our Estate Law Team Today

How We Can Help You

The estate planning process can be tricky. There are a number of approaches to it, but what you decide to include in your estate plan is up to your particular values, interests, and whether or not there are loved ones that you intend to pass your assets along to. Whether you are just starting your first draft or need to update an old and outdated one, we can help ensure all your bases are covered. We can help you continually update your estate plan when necessary. Thinking about the future and how to best manage your estate after your passing is not always simple or clear. Making plans for after death is not really what you would call having a “good time” per se, however, the alternative would be risking your legacy by going through the hoops of probate court where the government has more of a say in handling your assets.

If your estate does end up in probate court because you lacked an estate plan, this means more stress and frustration for your loved ones who will already be struggling after your passing. Not having an estate plan established can lead to family conflicts or other third parties attempting to seize a part of your wealth or one or more of your assets. Hiring our Memphis estate planning lawyer can help you achieve a sense of relief knowing that the distribution of your wealth is prepared for.

The Basics Of A Will

A will is a way to convey your final wishes regarding the disposition of personal property and individual assets. It is a legally binding document that will likely need to go through a court process called probate. This court process ensures that things get done per your wants and desires as outlined in the will.

For a will to be legal, it must contain certain things. First, you must appoint an executor. This is someone who you should either know very well and trust, such as a spouse or sibling, and who you know will be able to handle the duties of the position. The executor must be the liaison with the court and gather all necessary documents that are required under the probate process. The will must also be executed properly, in the presence of two unrelated witnesses.

What A Will Cannot Do

There are limitations to what can be accomplished in a will. If you are looking to do anything besides leave personal, singly owned property or assets to someone, you need to do it some other way.

A will also cannot:

- Pass on joint property

- Put conditions on inheritance

- Give money directly to someone without going through probate

- Leave money to a pet

- Disinherit a child

If you want to do anything listed above, you need to do so with other legal documents our estate planning attorney can help you create.

Other Ways To Pass Along Money

A will is not the only way you can leave something to heirs. Some accounts require you to name beneficiaries, such as life insurance policies, retirement accounts and trusts. These can be powerful tools in your estate planning arsenal.

Leaving Funeral Instructions

As you and your Memphis estate planning lawyer draw up your will, the topic of funeral preparations might arise. We recommend that you create a separate document that details your wishes for the funeral. This is because a will is typically not reviewed until after the funeral which means no one may even see your wishes until after it has already taken place. The document describing these wishes can be held by your attorney or given to the executor of the estate.

What Should Not Be Included In A Will

Avoiding Probate Pitfalls

Common Components Of An Estate Plan

- Wills And Trusts

A will determines what happens to your assets after going through the probate process. A living trust can be set up in order to avoid that probate process and to reduce taxes that the estate would have to pay. Living trusts often offer more flexibility as far as determining which heirs will receive which assets.

Special needs trusts can also be set up for families who have disabled or special needs children who could lose financial aid if the asset were put directly in the child’s name.

- Power Of Attorneys

Our Tennessee estate planning attorney can also assist you in drafting up legal documents that allow you to choose a power of attorney. This may be important in the event you become too ill or incapacitated to handle your own financial affairs.

- Legal Guardianships

If you have minor children, it is important to designate someone as the legal guardian of your children. This person would oversee financial issues pertaining to your children’s wellbeing and may also handle any assets your children inherit from your estate. There are also other types of legal guardianship that an estate planning attorney can assist with, including those for disabled or elderly adults.

- Advance Directives And Durable Health Care Power of Attorneys

Advance directives — also referred to as living wills — and durable health care power of attorneys (different from financial power of attorneys) are often drawn up together. These documents specifically express what your wishes are in the event you are nearing the end of life — either through an accident or illness — and that your wishes, not the wishes of loved ones, should be carried out.

- Estate Tax Planning

Taxes are often very complicated and estate tax planning is no less complicated. An estate planning lawyer can discuss all of the different options you may have to help alleviate the tax obligations your estate assets may create.

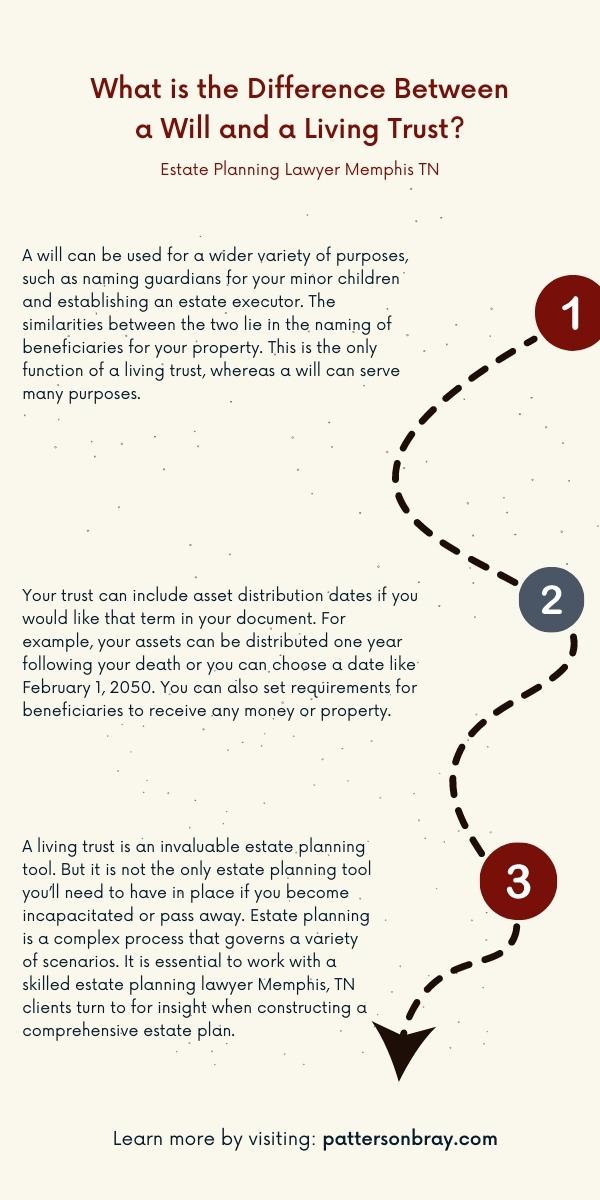

Memphis Estate Planning Infographic

Estate Planning Statistics

According to a survey conducted by Caring.com, more than 60 percent of Americans do not have wills drafted or any other estate planning tools in place. That comes out to two out of every three Americans.

FAQs

Why Should I Hire An Estate Planning Attorney?

Long-term care planning is part of the estate planning process. You may have worked hard for many years and would like your savings to provide you and your family with a good life. Perhaps you would like to pay for your grandchildren’s education or a round-the-world trip. If you fail to plan out your long-term care, you might risk losing money for the things you would like to do or give.

As you work with an Estate Planning Lawyer in Memphis, you might find that long-term care planning is one of the most challenging parts of the process. Part of the challenge comes from the very fact that you don’t know what will happen to you. For example, if your health declines, you may need to be placed in a nursing facility. On the other hand, you may be perfectly healthy until the day you die. Although it is difficult to predict what care you might need, if you do ever need it, the costs can be extremely high. The average cost of a standard nursing home facility in the U.S. is $6,000 – $8,000. This does not usually include treatment, surgery, or medications.

Regardless of your current state of health, it is inadvisable to ignore your long-term care considerations and planning. By organizing your long term care with an Estate Planning Lawyer in Tennessee, you can have a better chance at enjoying your retirement while also leaving a legacy to your heirs.

What Is A Trust?

A trust is a fiduciary arrangement where a third-party trustee, holds property as its nominal owner for the good of one or more beneficiaries. There are many different ways that trusts can be arranged that allow you to specify how and when assets pass on to your beneficiaries.

A living trust, or trust, is a legal document that contains any assets that you place into it. The trust owns the property until you pass away, at which point your assets are transferred to your beneficiaries. If you are considering this option as part of your estate plan, the lawyers at Patterson Bray can help you finalize your trust.

What’s The Difference Between A Will And Living Trust?

A will can be used for a wider variety of purposes, such as naming guardians for your minor children and establishing an estate executor. The similarities between the two lie in the naming of beneficiaries for your property. This is the only function of a living trust, whereas a will can serve many purposes. If you would like more clarification on the difference between these two legal documents, or guidance on which one is right for you, reach out to our estate planning lawyer in Memphis.

Does Property In A Living Trust Go Through Probate?

No, assets distributed through a trust are not subject to probate. This is one of the main advantages of trust. Forgoing probate court can save your loved ones time and stress, which is why many people choose this option.

Can I Set Terms In My Trust?

Yes, you can. Your trust can include asset distribution dates if you would like that term in your document. For example, your assets can be distributed one year following your death or you can choose a date like February 1, 2050. You can also set requirements for beneficiaries to receive any money or property. If you want to ensure your grandchildren graduate college before they receive their inheritance, you can include that requirement. This ability to control the conditions is another common reason people choose to use a trust.

Can I Make Changes To My Trust?

Yes, you can make changes to your trust, depending on the type of trust you have. If you have a revocable trust, you can modify, update, or even revoke it entirely during your lifetime, as long as you are mentally competent. Changes can include adding or removing beneficiaries, updating assets held in the trust, or changing the trustee.

To make these changes, you typically need to create a trust amendment or, in some cases, restate the trust entirely to ensure clarity and avoid confusion. It’s important to work with our Memphis estate planning attorney to make sure any changes comply with legal requirements and accurately reflect your intentions.

If your trust is irrevocable, changes are generally much more difficult and may require the consent of the beneficiaries or a court order, depending on the circumstances and applicable laws.

If you’re considering making changes, we recommend consulting with someone from our team to guide you through the process and protect your interests.

Patterson Bray PLLC, Memphis Estate Planning Lawyer

8001 Centerview Pkwy #103, Cordova, TN 38018

Contact Our Estate Lawyer Today

If you need to draw up estate planning documents, or you wish to update existing plans, contact us today. Our attorneys at Patterson Bray PLLC will take the time needed to discuss all your options and help determine what plans will benefit you and your family the most. Call and make an appointment with our Memphis estate planning lawyer at 901-372-5003, or fill out a contact form on our website.

Google Review

“My husband and I were in the market for an Estate Planning Attorney and came across Patterson Bray. Our experience could not have been better, extremely knowledgeable with regards to estate planning. I would highly recommend Patterson Bray!” – Rachael L.

Client Review

“My husband and I were in the market for an Estate Planning Attorney and came across Patterson Bray. Our experience could not have been better. Lindsay Jones was extremely knowledgeable with regards to estate planning. I would highly recommend Patterson Bray!”

Rachael Lloyd